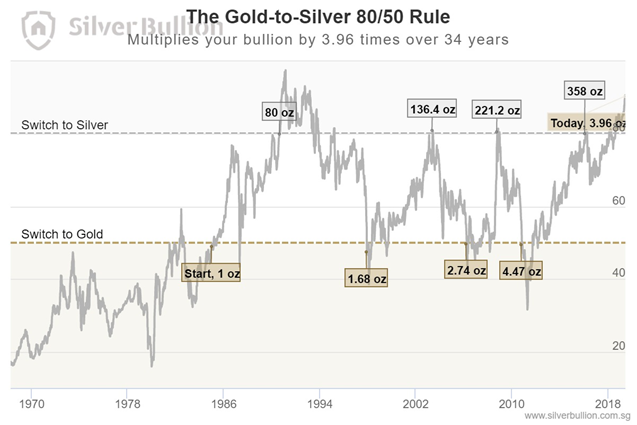

How to Purchase Silver Now and Get 60% More Gold Later

As we can observe from the chart above, the gold to silver ratio is currently at 88.75 as of May 31st 2019. A ratio of less than 20 and greater than 90 are rare outliers which occur only under extreme circumstances and do not normally last long as violent price reversals shortly happen afterward.

What does Gold to Silver ratio mean?

The gold to silver ratio indicates how much of silver is needed to exchange for gold. For an example, if the price of gold is $1,338 per ounce and the price of silver is $14.86 per ounce then the gold to silver ratio would be 90. In other words, it requires 90 ounce of silver to exchange for 1 ounce of gold.

Why does the Gold to Silver ratio matter?

The gold to silver ratio matters as it indicates whether gold is historically undervalued or overvalued as compared to silver. How do you tell if it is undervalued or overvalued? Simple, we just follow the 80 - 50 rule. Why 80 - 50?

- Since 1985, the gold to silver ratio has been hitting the 50 and 80 mark every 3 to 5 years hence it is what we consider the ‘sweet spot’.

- When the gold to silver ratio is at 50 or below, gold is undervalued as compared to silver.

- When the gold to silver ratio is at 80 or higher, silver is undervalued as compared to gold.

How can you take advantage of this?

When silver is undervalued compared to gold, hold silver. When silver is overvalued compared to gold, hold gold. This can be done through the Gold to Silver Switching Rule as it is designed to multiply your metal holdings by switching to the undervalued metal, without having to switch to fiat or dollars

- The Gold to Silver Switching Rule means selling gold and buying silver when the ratio hits 80 and selling silver and then buying gold when the ratio hits 50.

- Since 1985, the 80 -50 rule would have resulted in only 7 trades (roughly once every 3 to 5 years) resulting in 1 ounce of gold to become 4.9 ounce of gold (or silver equivalent).

- Applying the Gold to Silver Switching Rule will most likely, in the long run, increase your metal holdings resulting in more ounces in addition to the long term price increase.